Page 8 - Provissional Tax For Companies

P. 8

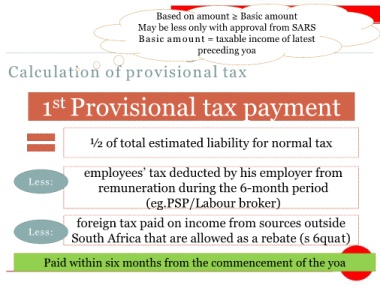

Based on amount ≥ Basic amount

May be less only with approval from SARS

Basic amount = taxable income of latest

preceding yoa

Calculation of provisional tax

st

1 Provisional tax payment

½ of total estimated liability for normal tax

employees’ tax deducted by his employer from

Less:

remuneration during the 6-month period

(eg.PSP/Labour broker)

foreign tax paid on income from sources outside

Less:

South Africa that are allowed as a rebate (s 6quat)

Paid within six months from the commencement of the yoa