Page 11 - Provissional Tax For Companies

P. 11

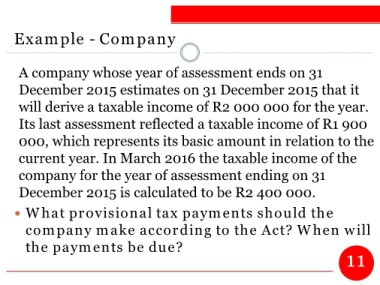

Example - Company

A company whose year of assessment ends on 31

December 2015 estimates on 31 December 2015 that it

will derive a taxable income of R2 000 000 for the year.

Its last assessment reflected a taxable income of R1 900

000, which represents its basic amount in relation to the

current year. In March 2016 the taxable income of the

company for the year of assessment ending on 31

December 2015 is calculated to be R2 400 000.

What provisional tax payments should the

company make according to the Act? When will

the payments be due?

11