Page 15 - Provissional Tax For Companies

P. 15

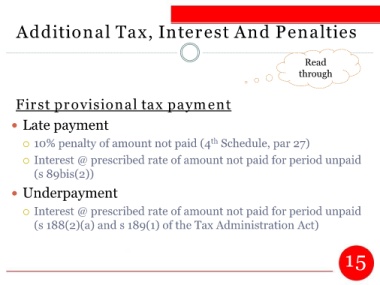

Additional Tax, Interest And Penalties

Read

through

First provisional tax payment

Late payment

th

10% penalty of amount not paid (4 Schedule, par 27)

Interest @ prescribed rate of amount not paid for period unpaid

(s 89bis(2))

Underpayment

Interest @ prescribed rate of amount not paid for period unpaid

(s 188(2)(a) and s 189(1) of the Tax Administration Act)

15