Page 18 - Provissional Tax For Companies

P. 18

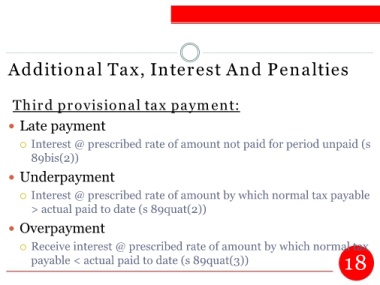

Additional Tax, Interest And Penalties

Third provisional tax payment:

Late payment

Interest @ prescribed rate of amount not paid for period unpaid (s

89bis(2))

Underpayment

Interest @ prescribed rate of amount by which normal tax payable

> actual paid to date (s 89quat(2))

Overpayment

Receive interest @ prescribed rate of amount by which normal tax

payable < actual paid to date (s 89quat(3)) 18