Page 16 - Provissional Tax For Companies

P. 16

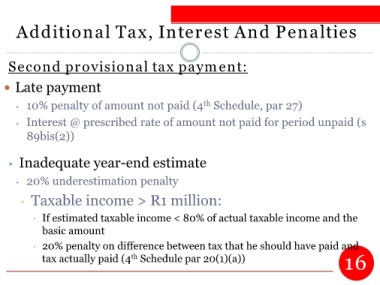

Additional Tax, Interest And Penalties

Second provisional tax payment:

Late payment

• 10% penalty of amount not paid (4 Schedule, par 27)

th

• Interest @ prescribed rate of amount not paid for period unpaid (s

89bis(2))

• Inadequate year-end estimate

• 20% underestimation penalty

▫ Taxable income > R1 million:

If estimated taxable income < 80% of actual taxable income and the

basic amount

20% penalty on difference between tax that he should have paid and

tax actually paid (4 Schedule par 20(1)(a)) 16

th