Page 13 - Provissional Tax For Companies

P. 13

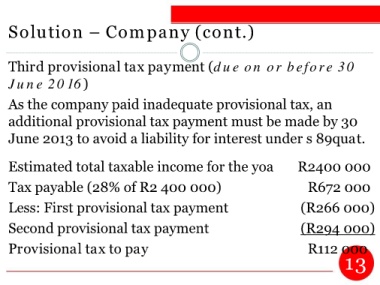

Solution – Company (cont.)

Third provisional tax payment (due on or before 30

June 2016)

As the company paid inadequate provisional tax, an

additional provisional tax payment must be made by 30

June 2013 to avoid a liability for interest under s 89quat.

Estimated total taxable income for the yoa R2400 000

Tax payable (28% of R2 400 000) R672 000

Less: First provisional tax payment (R266 000)

Second provisional tax payment (R294 000)

Provisional tax to pay R112 000

13