Page 36 - Test 1 Slides - 4. Gross Income

P. 36

GROSS INCOME

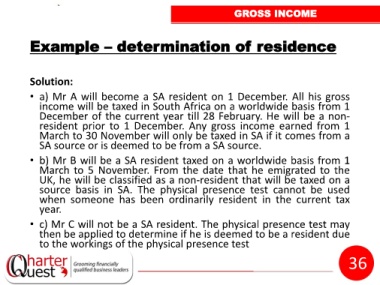

Example – determination of residence

Solution:

• a) Mr A will become a SA resident on 1 December. All his gross

income will be taxed in South Africa on a worldwide basis from 1

December of the current year till 28 February. He will be a non-

resident prior to 1 December. Any gross income earned from 1

March to 30 November will only be taxed in SA if it comes from a

SA source or is deemed to be from a SA source.

• b) Mr B will be a SA resident taxed on a worldwide basis from 1

March to 5 November. From the date that he emigrated to the

UK, he will be classified as a non-resident that will be taxed on a

source basis in SA. The physical presence test cannot be used

when someone has been ordinarily resident in the current tax

year.

• c) Mr C will not be a SA resident. The physical presence test may

then be applied to determine if he is deemed to be a resident due

to the workings of the physical presence test

36