Page 39 - Test 1 Slides - 4. Gross Income

P. 39

GROSS INCOME

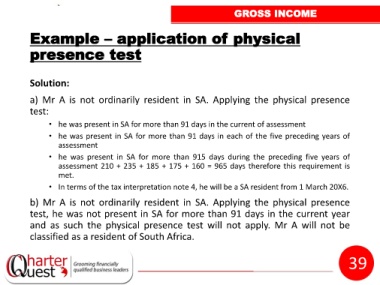

Example – application of physical

presence test

Solution:

a) Mr A is not ordinarily resident in SA. Applying the physical presence

test:

• he was present in SA for more than 91 days in the current of assessment

• he was present in SA for more than 91 days in each of the five preceding years of

assessment

• he was present in SA for more than 915 days during the preceding five years of

assessment 210 + 235 + 185 + 175 + 160 = 965 days therefore this requirement is

met.

• In terms of the tax interpretation note 4, he will be a SA resident from 1 March 20X6.

b) Mr A is not ordinarily resident in SA. Applying the physical presence

test, he was not present in SA for more than 91 days in the current year

and as such the physical presence test will not apply. Mr A will not be

classified as a resident of South Africa.

39