Page 406 - F2 Integrated Workbook STUDENT 2019

P. 406

Chapter 19

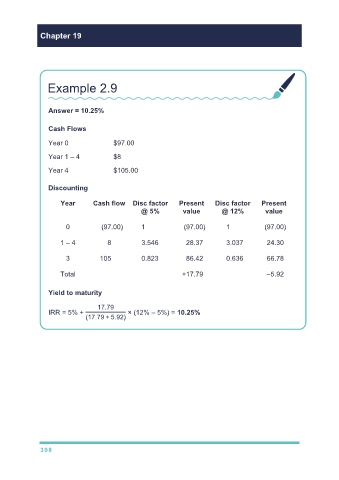

Example 2.9

Answer = 10.25%

Cash Flows

Year 0 $97.00

Year 1 – 4 $8

Year 4 $105.00

Discounting

Year Cash flow Disc factor Present Disc factor Present

@ 5% value @ 12% value

0 (97.00) 1 (97.00) 1 (97.00)

1 – 4 8 3.546 28.37 3.037 24.30

3 105 0.823 86.42 0.636 66.78

Total +17.79 –5.92

Yield to maturity

17.79

IRR = 5% + × (12% – 5%) = 10.25%

(17.79 + 5.92)

398