Page 409 - F2 Integrated Workbook STUDENT 2019

P. 409

Answers

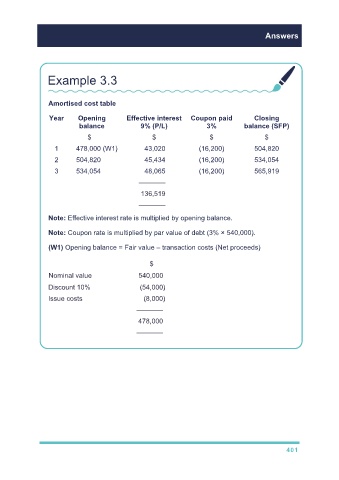

Example 3.3

Amortised cost table

Year Opening Effective interest Coupon paid Closing

balance 9% (P/L) 3% balance (SFP)

$ $ $ $

1 478,000 (W1) 43,020 (16,200) 504,820

2 504,820 45,434 (16,200) 534,054

3 534,054 48,065 (16,200) 565,919

–––––––

136,519

–––––––

Note: Effective interest rate is multiplied by opening balance.

Note: Coupon rate is multiplied by par value of debt (3% × 540,000).

(W1) Opening balance = Fair value – transaction costs (Net proceeds)

$

Nominal value 540,000

Discount 10% (54,000)

Issue costs (8,000)

–––––––

478,000

–––––––

401