Page 416 - F2 Integrated Workbook STUDENT 2019

P. 416

Chapter 19

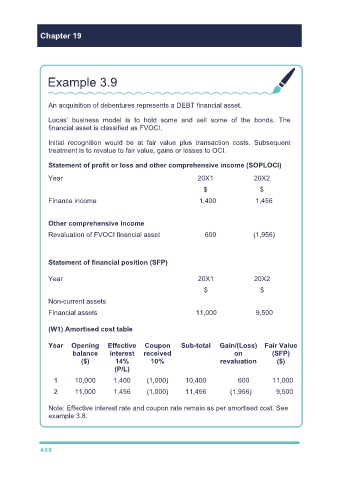

Example 3.9

An acquisition of debentures represents a DEBT financial asset.

Lucas’ business model is to hold some and sell some of the bonds. The

financial asset is classified as FVOCI.

Initial recognition would be at fair value plus transaction costs. Subsequent

treatment is to revalue to fair value, gains or losses to OCI.

Statement of profit or loss and other comprehensive income (SOPLOCI)

Year 20X1 20X2

$ $

Finance income 1,400 1,456

Other comprehensive income

Revaluation of FVOCI financial asset 600 (1,956)

Statement of financial position (SFP)

Year 20X1 20X2

$ $

Non-current assets

Financial assets 11,000 9,500

(W1) Amortised cost table

Year Opening Effective Coupon Sub-total Gain/(Loss) Fair Value

balance interest received on (SFP)

($) 14% 10% revaluation ($)

(P/L)

1 10,000 1,400 (1,000) 10,400 600 11,000

2 11,000 1,456 (1,000) 11,456 (1,956) 9,500

Note: Effective interest rate and coupon rate remain as per amortised cost. See

example 3.8.

408