Page 420 - F2 Integrated Workbook STUDENT 2019

P. 420

Chapter 19

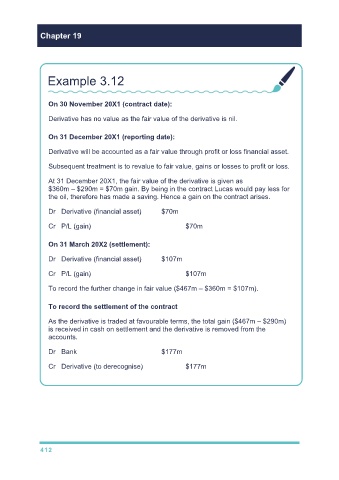

Example 3.12

On 30 November 20X1 (contract date):

Derivative has no value as the fair value of the derivative is nil.

On 31 December 20X1 (reporting date):

Derivative will be accounted as a fair value through profit or loss financial asset.

Subsequent treatment is to revalue to fair value, gains or losses to profit or loss.

At 31 December 20X1, the fair value of the derivative is given as

$360m – $290m = $70m gain. By being in the contract Lucas would pay less for

the oil, therefore has made a saving. Hence a gain on the contract arises.

Dr Derivative (financial asset) $70m

Cr P/L (gain) $70m

On 31 March 20X2 (settlement):

Dr Derivative (financial asset) $107m

Cr P/L (gain) $107m

To record the further change in fair value ($467m – $360m = $107m).

To record the settlement of the contract

As the derivative is traded at favourable terms, the total gain ($467m – $290m)

is received in cash on settlement and the derivative is removed from the

accounts.

Dr Bank $177m

Cr Derivative (to derecognise) $177m

412