Page 21 - Trading Stock

P. 21

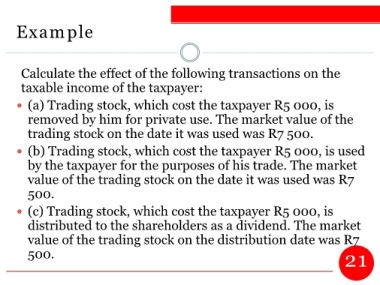

Example

Calculate the effect of the following transactions on the

taxable income of the taxpayer:

(a) Trading stock, which cost the taxpayer R5 000, is

removed by him for private use. The market value of the

trading stock on the date it was used was R7 500.

(b) Trading stock, which cost the taxpayer R5 000, is used

by the taxpayer for the purposes of his trade. The market

value of the trading stock on the date it was used was R7

500.

(c) Trading stock, which cost the taxpayer R5 000, is

distributed to the shareholders as a dividend. The market

value of the trading stock on the distribution date was R7

500. 21