Page 23 - Trading Stock

P. 23

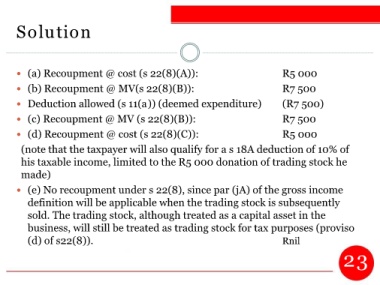

Solution

(a) Recoupment @ cost (s 22(8)(A)): R5 000

(b) Recoupment @ MV(s 22(8)(B)): R7 500

Deduction allowed (s 11(a)) (deemed expenditure) (R7 500)

(c) Recoupment @ MV (s 22(8)(B)): R7 500

(d) Recoupment @ cost (s 22(8)(C)): R5 000

(note that the taxpayer will also qualify for a s 18A deduction of 10% of

his taxable income, limited to the R5 000 donation of trading stock he

made)

(e) No recoupment under s 22(8), since par (jA) of the gross income

definition will be applicable when the trading stock is subsequently

sold. The trading stock, although treated as a capital asset in the

business, will still be treated as trading stock for tax purposes (proviso

(d) of s22(8)). Rnil

23