Page 22 - Trading Stock

P. 22

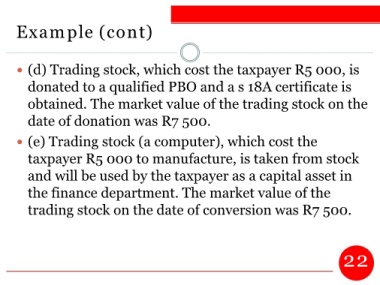

Example (cont)

(d) Trading stock, which cost the taxpayer R5 000, is

donated to a qualified PBO and a s 18A certificate is

obtained. The market value of the trading stock on the

date of donation was R7 500.

(e) Trading stock (a computer), which cost the

taxpayer R5 000 to manufacture, is taken from stock

and will be used by the taxpayer as a capital asset in

the finance department. The market value of the

trading stock on the date of conversion was R7 500.

22