Page 404 - PM Integrated Workbook 2018-19

P. 404

Chapter 15

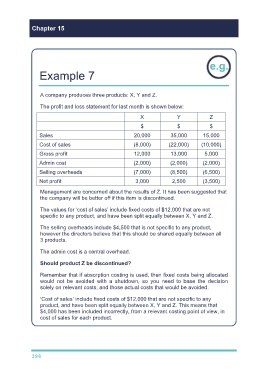

Example 7

A company produces three products: X, Y and Z.

The profit and loss statement for last month is shown below:

X Y Z

$ $ $

Sales 20,000 35,000 15,000

Cost of sales (8,000) (22,000) (10,000)

Gross profit 12,000 13,000 5,000

Admin cost (2,000) (2,000) (2,000)

Selling overheads (7,000) (8,500) (6,500)

Net profit 3,000 2,500 (3,500)

Management are concerned about the results of Z. It has been suggested that

the company will be better off if this item is discontinued.

The values for ‘cost of sales’ include fixed costs of $12,000 that are not

specific to any product, and have been split equally between X, Y and Z.

The selling overheads include $4,500 that is not specific to any product,

however the directors believe that this should be shared equally between all

3 products.

The admin cost is a central overhead.

Should product Z be discontinued?

Remember that if absorption costing is used, then fixed costs being allocated

would not be avoided with a shutdown, so you need to base the decision

solely on relevant costs, and those actual costs that would be avoided.

‘Cost of sales’ include fixed costs of $12,000 that are not specific to any

product, and have been split equally between X, Y and Z. This means that

$4,000 has been included incorrectly, from a relevant costing point of view, in

cost of sales for each product.

396