Page 405 - PM Integrated Workbook 2018-19

P. 405

Answers

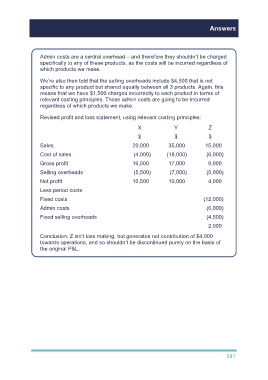

Admin costs are a central overhead – and therefore they shouldn’t be charged

specifically to any of these products, as the costs will be incurred regardless of

which products we make.

We’re also then told that the selling overheads include $4,500 that is not

specific to any product but shared equally between all 3 products. Again, this

means that we have $1,500 charged incorrectly to each product in terms of

relevant costing principles. Those admin costs are going to be Incurred

regardless of which products we make.

Revised profit and loss statement, using relevant costing principles:

X Y Z

$ $ $

Sales 20,000 35,000 15,000

Cost of sales (4,000) (18,000) (6,000)

Gross profit 16,000 17,000 9,000

Selling overheads (5,500) (7,000) (5,000)

Net profit 10,500 10,000 4,000

Less period costs

Fixed costs (12,000)

Admin costs (6,000)

Fixed selling overheads (4,500)

2,000

Conclusion: Z isn’t loss making, but generates net contribution of $4,000

towards operations, and so shouldn’t be discontinued purely on the basis of

the original P&L.

397