Page 400 - PM Integrated Workbook 2018-19

P. 400

Chapter 15

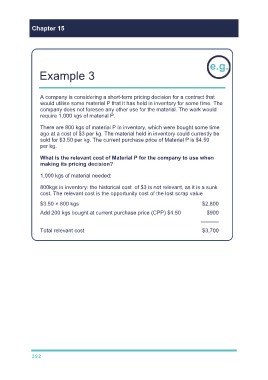

Example 3

A company is considering a short-term pricing decision for a contract that

would utilise some material P that it has held in inventory for some time. The

company does not foresee any other use for the material. The work would

require 1,000 kgs of material P.

There are 800 kgs of material P in inventory, which were bought some time

ago at a cost of $3 per kg. The material held in inventory could currently be

sold for $3.50 per kg. The current purchase price of Material P is $4.50

per kg.

What is the relevant cost of Material P for the company to use when

making its pricing decision?

1,000 kgs of material needed:

800kgs in inventory: the historical cost of $3 is not relevant, as it is a sunk

cost. The relevant cost is the opportunity cost of the lost scrap value

$3.50 × 800 kgs $2,800

Add 200 kgs bought at current purchase price (CPP) $4.50 $900

––––––

Total relevant cost $3,700

392