Page 11 - P6 Slide Taxation - Lecture Day 6 - Groups, Interest And Practice Questions

P. 11

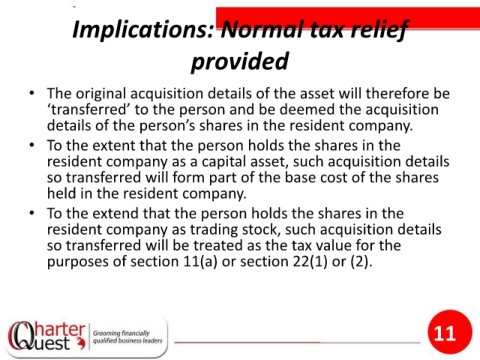

Implications: Normal tax relief

provided

• The original acquisition details of the asset will therefore be

‘transferred’ to the person and be deemed the acquisition

details of the person’s shares in the resident company.

• To the extent that the person holds the shares in the

resident company as a capital asset, such acquisition details

so transferred will form part of the base cost of the shares

held in the resident company.

• To the extend that the person holds the shares in the

resident company as trading stock, such acquisition details

so transferred will be treated as the tax value for the

purposes of section 11(a) or section 22(1) or (2).

11