Page 13 - P6 Slide Taxation - Lecture Day 6 - Groups, Interest And Practice Questions

P. 13

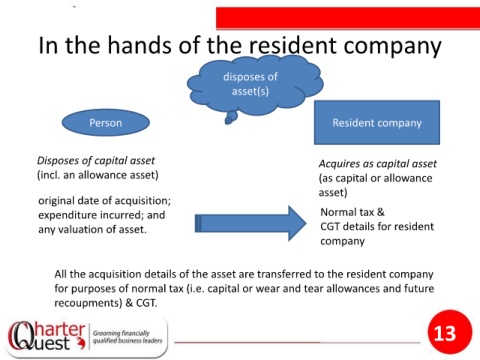

In the hands of the resident company

disposes of

asset(s)

Person Resident company

Disposes of capital asset Acquires as capital asset

(incl. an allowance asset) (as capital or allowance

asset)

original date of acquisition;

expenditure incurred; and Normal tax &

any valuation of asset. CGT details for resident

company

All the acquisition details of the asset are transferred to the resident company

for purposes of normal tax (i.e. capital or wear and tear allowances and future

recoupments) & CGT.

13