Page 17 - P6 Slide Taxation - Lecture Day 6 - Groups, Interest And Practice Questions

P. 17

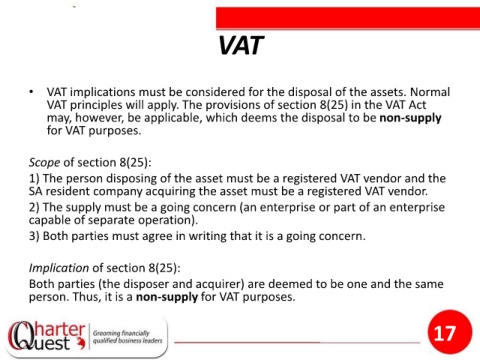

VAT

• VAT implications must be considered for the disposal of the assets. Normal

VAT principles will apply. The provisions of section 8(25) in the VAT Act

may, however, be applicable, which deems the disposal to be non-supply

for VAT purposes.

Scope of section 8(25):

1) The person disposing of the asset must be a registered VAT vendor and the

SA resident company acquiring the asset must be a registered VAT vendor.

2) The supply must be a going concern (an enterprise or part of an enterprise

capable of separate operation).

3) Both parties must agree in writing that it is a going concern.

Implication of section 8(25):

Both parties (the disposer and acquirer) are deemed to be one and the same

person. Thus, it is a non-supply for VAT purposes.

17