Page 46 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 46

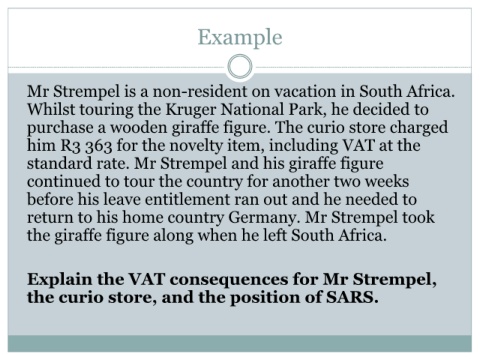

Example

Mr Strempel is a non-resident on vacation in South Africa.

Whilst touring the Kruger National Park, he decided to

purchase a wooden giraffe figure. The curio store charged

him R3 363 for the novelty item, including VAT at the

standard rate. Mr Strempel and his giraffe figure

continued to tour the country for another two weeks

before his leave entitlement ran out and he needed to

return to his home country Germany. Mr Strempel took

the giraffe figure along when he left South Africa.

Explain the VAT consequences for Mr Strempel,

the curio store, and the position of SARS.