Page 47 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 47

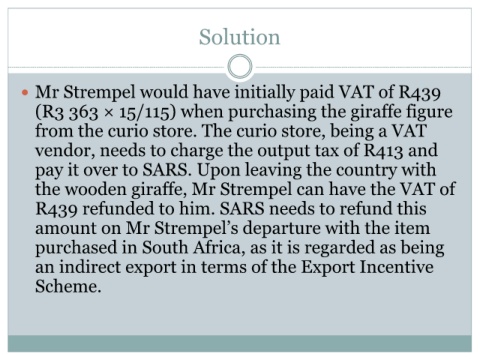

Solution

Mr Strempel would have initially paid VAT of R439

(R3 363 × 15/115) when purchasing the giraffe figure

from the curio store. The curio store, being a VAT

vendor, needs to charge the output tax of R413 and

pay it over to SARS. Upon leaving the country with

the wooden giraffe, Mr Strempel can have the VAT of

R439 refunded to him. SARS needs to refund this

amount on Mr Strempel’s departure with the item

purchased in South Africa, as it is regarded as being

an indirect export in terms of the Export Incentive

Scheme.