Page 52 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 52

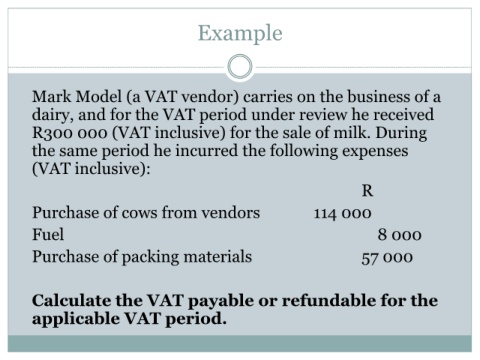

Example

Mark Model (a VAT vendor) carries on the business of a

dairy, and for the VAT period under review he received

R300 000 (VAT inclusive) for the sale of milk. During

the same period he incurred the following expenses

(VAT inclusive):

R

Purchase of cows from vendors 114 000

Fuel 8 000

Purchase of packing materials 57 000

Calculate the VAT payable or refundable for the

applicable VAT period.