Page 54 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 54

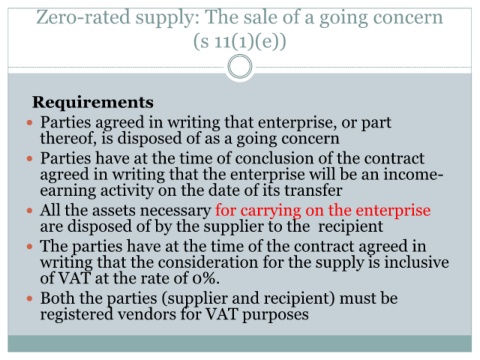

Zero-rated supply: The sale of a going concern

(s 11(1)(e))

Requirements

Parties agreed in writing that enterprise, or part

thereof, is disposed of as a going concern

Parties have at the time of conclusion of the contract

agreed in writing that the enterprise will be an income-

earning activity on the date of its transfer

All the assets necessary for carrying on the enterprise

are disposed of by the supplier to the recipient

The parties have at the time of the contract agreed in

writing that the consideration for the supply is inclusive

of VAT at the rate of 0%.

Both the parties (supplier and recipient) must be

registered vendors for VAT purposes