Page 53 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 53

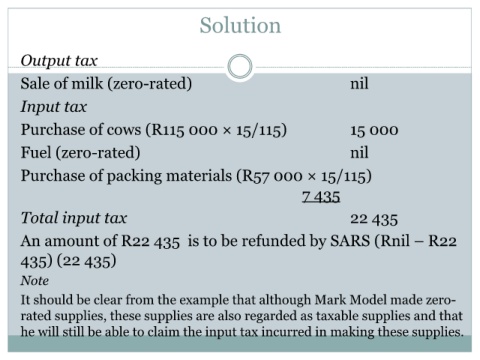

Solution

Output tax

Sale of milk (zero-rated) nil

Input tax

Purchase of cows (R115 000 × 15/115) 15 000

Fuel (zero-rated) nil

Purchase of packing materials (R57 000 × 15/115)

7 435

Total input tax 22 435

An amount of R22 435 is to be refunded by SARS (Rnil – R22

435) (22 435)

Note

It should be clear from the example that although Mark Model made zero-

rated supplies, these supplies are also regarded as taxable supplies and that

he will still be able to claim the input tax incurred in making these supplies.