Page 51 - P6 Slide Taxation - Lecture Day 5 - VAT Part 1

P. 51

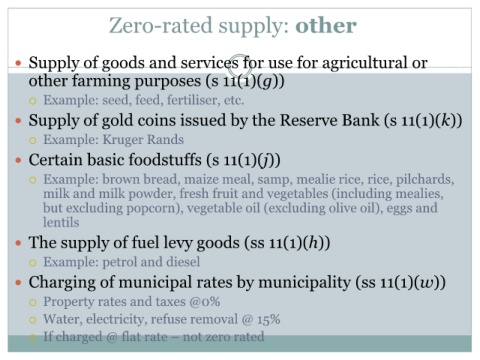

Zero-rated supply: other

Supply of goods and services for use for agricultural or

other farming purposes (s 11(1)(g))

Example: seed, feed, fertiliser, etc.

Supply of gold coins issued by the Reserve Bank (s 11(1)(k))

Example: Kruger Rands

Certain basic foodstuffs (s 11(1)(j))

Example: brown bread, maize meal, samp, mealie rice, rice, pilchards,

milk and milk powder, fresh fruit and vegetables (including mealies,

but excluding popcorn), vegetable oil (excluding olive oil), eggs and

lentils

The supply of fuel levy goods (ss 11(1)(h))

Example: petrol and diesel

Charging of municipal rates by municipality (ss 11(1)(w))

Property rates and taxes @0%

Water, electricity, refuse removal @ 15%

If charged @ flat rate – not zero rated