Page 33 - TAX4862/2 APPLIED TAXATION

P. 33

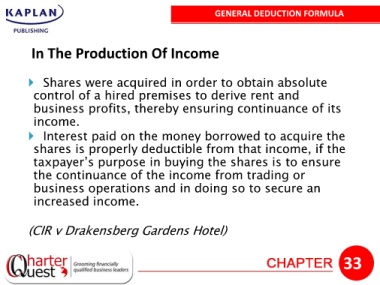

GENERAL DEDUCTION FORMULA

In The Production Of Income

Shares were acquired in order to obtain absolute

control of a hired premises to derive rent and

business profits, thereby ensuring continuance of its

income.

Interest paid on the money borrowed to acquire the

shares is properly deductible from that income, if the

taxpayer’s purpose in buying the shares is to ensure

the continuance of the income from trading or

business operations and in doing so to secure an

increased income.

(CIR v Drakensberg Gardens Hotel)

33