Page 34 - TAX4862/2 APPLIED TAXATION

P. 34

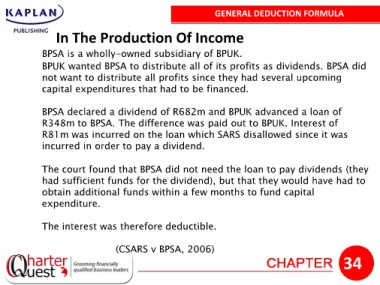

GENERAL DEDUCTION FORMULA

In The Production Of Income

BPSA is a wholly-owned subsidiary of BPUK.

BPUK wanted BPSA to distribute all of its profits as dividends. BPSA did

not want to distribute all profits since they had several upcoming

capital expenditures that had to be financed.

BPSA declared a dividend of R682m and BPUK advanced a loan of

R348m to BPSA. The difference was paid out to BPUK. Interest of

R81m was incurred on the loan which SARS disallowed since it was

incurred in order to pay a dividend.

The court found that BPSA did not need the loan to pay dividends (they

had sufficient funds for the dividend), but that they would have had to

obtain additional funds within a few months to fund capital

expenditure.

The interest was therefore deductible.

(CSARS v BPSA, 2006)

34