Page 37 - TAX4862/2 APPLIED TAXATION

P. 37

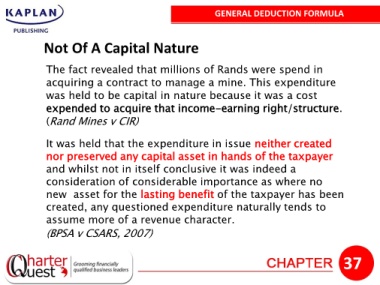

GENERAL DEDUCTION FORMULA

Not Of A Capital Nature

The fact revealed that millions of Rands were spend in

acquiring a contract to manage a mine. This expenditure

was held to be capital in nature because it was a cost

expended to acquire that income-earning right/structure.

(Rand Mines v CIR)

It was held that the expenditure in issue neither created

nor preserved any capital asset in hands of the taxpayer

and whilst not in itself conclusive it was indeed a

consideration of considerable importance as where no

new asset for the lasting benefit of the taxpayer has been

created, any questioned expenditure naturally tends to

assume more of a revenue character.

(BPSA v CSARS, 2007)

37