Page 13 - FINAL CFA I SLIDES JUNE 2019 DAY 3

P. 13

Session Unit 2:

9. Probability Concepts

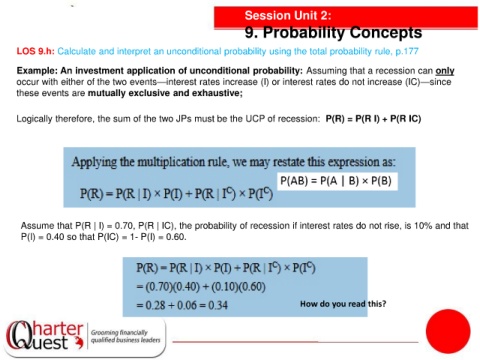

LOS 9.h: Calculate and interpret an unconditional probability using the total probability rule, p.177

Example: An investment application of unconditional probability: Assuming that a recession can only

occur with either of the two events—interest rates increase (I) or interest rates do not increase (IC)—since

these events are mutually exclusive and exhaustive;

Logically therefore, the sum of the two JPs must be the UCP of recession: P(R) = P(R I) + P(R IC)

Assume that P(R | I) = 0.70, P(R | IC), the probability of recession if interest rates do not rise, is 10% and that

P(I) = 0.40 so that P(IC) = 1- P(I) = 0.60.

How do you read this?