Page 17 - FINAL CFA I SLIDES JUNE 2019 DAY 3

P. 17

Session Unit 2:

LOS 9.h: Calculate and interpret an unconditional

probability using the total probability rule. 9. Probability Concepts

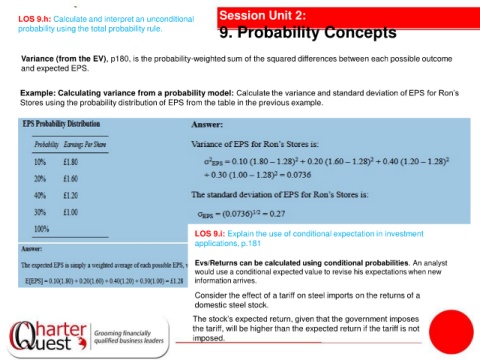

Variance (from the EV), p180, is the probability-weighted sum of the squared differences between each possible outcome

and expected EPS.

Example: Calculating variance from a probability model: Calculate the variance and standard deviation of EPS for Ron’s

Stores using the probability distribution of EPS from the table in the previous example.

LOS 9.i: Explain the use of conditional expectation in investment

applications, p.181

Evs/Returns can be calculated using conditional probabilities. An analyst

would use a conditional expected value to revise his expectations when new

information arrives.

Consider the effect of a tariff on steel imports on the returns of a

domestic steel stock.

The stock’s expected return, given that the government imposes

the tariff, will be higher than the expected return if the tariff is not

imposed.