Page 79 - FINAL CFA I SLIDES JUNE 2019 DAY 3

P. 79

Session Unit 2:

8. Statistical Concepts and Market Returns

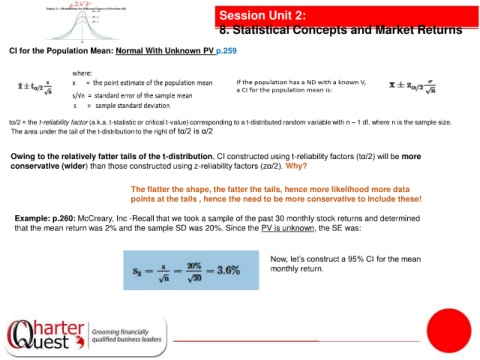

CI for the Population Mean: Normal With Unknown PV p.259

tα/2 = the t-reliability factor (a.k.a. t-statistic or critical t-value) corresponding to a t-distributed random variable with n – 1 df, where n is the sample size.

The area under the tail of the t-distribution to the right of tα/2 is α/2

`

Owing to the relatively fatter tails of the t-distribution, CI constructed using t-reliability factors (tα/2) will be more

conservative (wider) than those constructed using z-reliability factors (zα/2). Why?

The flatter the shape, the fatter the tails, hence more likelihood more data

points at the tails , hence the need to be more conservative to include these!

Example: p.260: McCreary, Inc -Recall that we took a sample of the past 30 monthly stock returns and determined

that the mean return was 2% and the sample SD was 20%. Since the PV is unknown, the SE was:

Now, let’s construct a 95% CI for the mean

monthly return.