Page 80 - FINAL CFA I SLIDES JUNE 2019 DAY 3

P. 80

Session Unit 2:

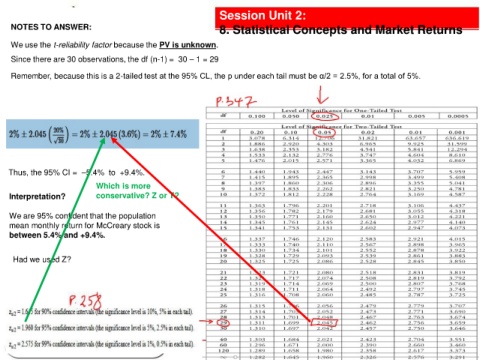

NOTES TO ANSWER: 8. Statistical Concepts and Market Returns

We use the t-reliability factor because the PV is unknown.

Since there are 30 observations, the df (n-1) = 30 – 1 = 29

Remember, because this is a 2-tailed test at the 95% CL, the p under each tail must be α/2 = 2.5%, for a total of 5%.

Thus, the 95% CI = –5.4% to +9.4%.

Which is more

Interpretation? conservative? Z or T?

We are 95% confident that the population

mean monthly return for McCreary stock is

between 5.4% and +9.4%.

Had we used Z?