Page 18 - MCOM MODEL ANSWER 2

P. 18

P a g e | 18

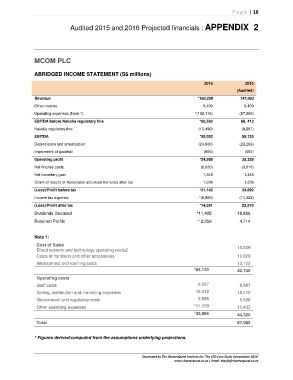

Audited 2015 and 2016 Projected financials : APPENDIX 2

MCOM PLC

ABRIDGED INCOME STATEMENT (S$ millions)

2016 2015

(Audited)

Revenue *160,299 147,063

Other income 8,409 8,409

Operating expenses (Note 1) *(108,116) (87,060)

EBITDA before Nakolia regulatory fine *60,592 68, 412

Nakolia regulatory fine (10,499) (9,287)

EBITDA *50,093 59,125

Depreciation and amortisation (24,900) (23,293)

Impairment of goodwill (605) (504)

Operating profit *24,588 35,328

Net finance costs (6,020) (3,010)

Net monetary gain 1,348 1,348

Share of results of Associates and Joint Ventures after tax 1,226 1,226

(Loss)/Profit before tax *21,142 34,892

Income tax expense *(6,860) (11,322)

(Loss)/Profit after tax *14,281 23,570

Dividends Declared *11,425 18,856

Retained Profits * 2,856 4,714

Note 1:

Cost of Sales

Direct network and technology operating costs2 18,809

Costs of handsets and other accessories 10,829

Interconnect and roaming costs 13,102

*64,120 42,740

Operating costs

Staff costs 8.587 8,587

Selling, distribution and marketing expenses 18,412 18,412

Government and regulatory costs 5,888 5,888

Other operating expenses *11,109 11,433

*43,996 44,320

Total 87,060

* Figures derived/computed from the assumptions underlying projections.

Developed by The CharterQuest Institute for 'The CFO Case Study Competition 2016'

www.charterquest.co.za | Email: thecfo@charterquest.co.za