Page 14 - MCOM MODEL ANSWER 2

P. 14

P a g e | 14

1. DEAL DUE DILIGENCE (TOP 5 ISSUES)

First and foremost, we now have our audited 2015 report. We must check that we continue to

meet the two bid Critical Success Factors: Ability to raise finance, measured as book value

gearing and environmental track record.

Secondly, do a close evaluation of their non-financial objectives e.g. number of subscribers,

customer life cycle, the average revenue per user etc. It appears implausible for CloudNet with

63 million subscribers to be far less valuable than our investment in JV Cellular (see our prior

board report calling for professional skepticism).

Thirdly, check if any members of CloundNet's senior/executive management have

contractual terms that will result in significant payouts to them (e.g. on change of ownership

of the company or their being made redundant)? Also check if any of these senior

executives, especially the ones substantially involved in directing the 'other digital' business

activities will be happy to enter into extended contracts with us as new owners? Keep in

mind our ability to extract synergies from their other digital business, as the principal growth

and strategic consideration of why we want to enter this market, will depend on our ability to

retain these executives.

Fourthly, what contracts with clients, if any, will lapse or be made void in the event that

CloudNet is purchased? The Free Cash Flows (FCF) that underpin CloudNet's valuation

significantly depends on our ability to retain/improve on the number and quality of clients.

Fifth, what events since its last audited financial statements were published have made a

significant impact on CloundNet's assets, liabilities, operating capability and/or cash flows?

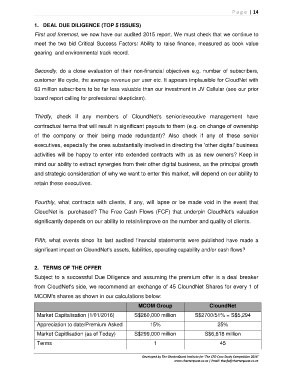

2. TERMS OF THE OFFER

Subject to a successful Due Diligence and assuming the premium offer is a deal breaker

from CloudNet's side, we recommend an exchange of 45 CloundNet Shares for every 1 of

MCOM's shares as shown in our calculations below:

MCOM Group CloundNet

Market Capitalisation (1/01/2016) S$260,000 million S$2700/51% = S$5,294

Appreciation to date/Premium Asked 15% 25%

Market Capitlisation (as of Today) S$299,000 million S$6,618 million

Terms 1 45

Developed by The CharterQuest Institute for 'The CFO Case Study Competition 2016'

www.charterquest.co.za | Email: thecfo@charterquest.co.za