Page 11 - MCOM MODEL ANSWER 2

P. 11

P a g e | 11

ACTIONS

The Group HR Director should invite Johan in for formal consultations with the Group CEO, the

chair of the nominations and remuneration committees with a view to making an offer. Group

Marketing should effect a PR plan to proactively manage any public criticisms about MCOM's

commitment to Affirmative Action or Transformation. Care should be taken to ensure the two

internal candidates not selected continue to serve and remain motivated and provide support to

the decision. The Board needs to also clarify its continued commitment to succession planning

internally and externally. Before making this appointment, the Board and Group HR must take

steps to motivate the current Group CEO and secure his commitment to serve as interim Group

CEO for the full 12 months notice period required by Johan Van Rendsberg. If any of the above

measures fail, the board should seriously consider rather appointing Mtelo Myati as the second

most qualified candidate.

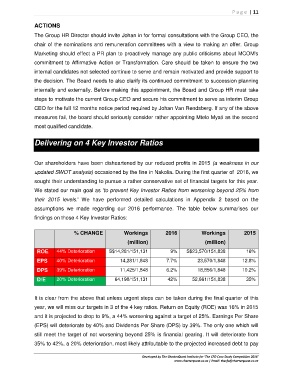

Delivering on 4 Key Investor Ratios

Our shareholders have been disheartened by our reduced profits in 2015 (a weakness in our

updated SWOT analysis) occasioned by the fine in Nakolia. During the first quarter of 2016, we

sought their understanding to pursue a rather conservative set of financial targets for this year.

We stated our main goal as 'to prevent Key Investor Ratios from worsening beyond 25% from

their 2015 levels.' We have performed detailed calculations in Appendix 2 based on the

assumptions we made regarding our 2016 performance. The table below summarises our

findings on those 4 Key Investor Ratios:

% CHANGE Workings 2016 Workings 2015

(million) (million)

ROE 44% Deterioration S$14,281/151,131 9% S$23,570/151,838 16%

EPS 40% Deterioration 14,281/1,848 7.7% 23,570/1,848 12.8%

DPS 39% Deterioration 11,425/1,848 6.2% 18,856/1,848 10.2%

D/E 20% Deterioration 64,190/151,131 42% 52,661/151,838 35%

It is clear from the above that unless urgent steps can be taken during the final quarter of this

year, we will miss our targets in 3 of the 4 key ratios. Return on Equity (ROE) was 16% in 2015

and it is projected to drop to 9%, a 44% worsening against a target of 25%. Earnings Per Share

(EPS) will deteriorate by 40% and Dividends Per Share (DPS) by 39%. The only one which will

still meet the target of not worsening beyond 25% is financial gearing. It will deteriorate from

35% to 42%, a 20% deterioration, most likely attributable to the projected increased debt to pay

Developed by The CharterQuest Institute for 'The CFO Case Study Competition 2016'

www.charterquest.co.za | Email: thecfo@charterquest.co.za