Page 14 - P6 Slide Taxation - Lecture Day 5 - Trading stock

P. 14

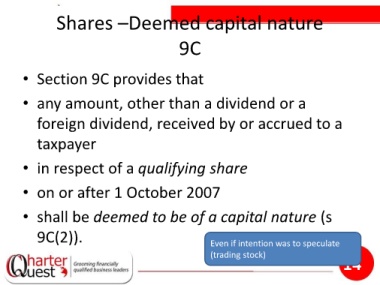

Shares –Deemed capital nature

9C

• Section 9C provides that

• any amount, other than a dividend or a

foreign dividend, received by or accrued to a

taxpayer

• in respect of a qualifying share

• on or after 1 October 2007

• shall be deemed to be of a capital nature (s

9C(2)).

Even if intention was to speculate

(trading stock)

14