Page 11 - P6 Slide Taxation - Lecture Day 5 - Trading stock

P. 11

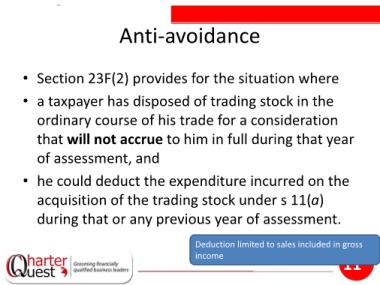

Anti-avoidance

• Section 23F(2) provides for the situation where

• a taxpayer has disposed of trading stock in the

ordinary course of his trade for a consideration

that will not accrue to him in full during that year

of assessment, and

• he could deduct the expenditure incurred on the

acquisition of the trading stock under s 11(a)

during that or any previous year of assessment.

Deduction limited to sales included in gross

income

11