Page 7 - P6 Slide Taxation - Lecture Day 5 - Trading stock

P. 7

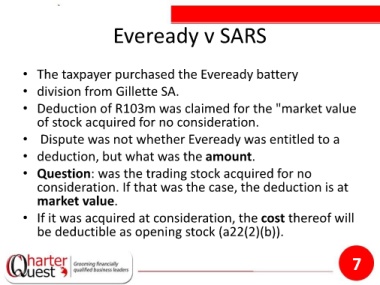

Eveready v SARS

• The taxpayer purchased the Eveready battery

• division from Gillette SA.

• Deduction of R103m was claimed for the "market value

of stock acquired for no consideration.

• Dispute was not whether Eveready was entitled to a

• deduction, but what was the amount.

• Question: was the trading stock acquired for no

consideration. If that was the case, the deduction is at

market value.

• If it was acquired at consideration, the cost thereof will

be deductible as opening stock (a22(2)(b)).

7