Page 10 - P6 Slide Taxation - Lecture Day 5 - Trading stock

P. 10

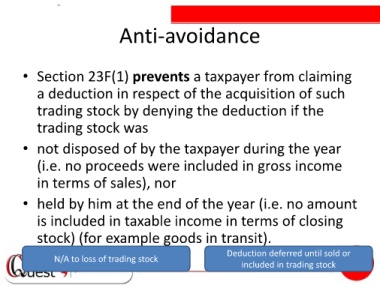

Anti-avoidance

• Section 23F(1) prevents a taxpayer from claiming

a deduction in respect of the acquisition of such

trading stock by denying the deduction if the

trading stock was

• not disposed of by the taxpayer during the year

(i.e. no proceeds were included in gross income

in terms of sales), nor

• held by him at the end of the year (i.e. no amount

is included in taxable income in terms of closing

stock) (for example goods in transit).

Deduction deferred until sold or

N/A to loss of trading stock

included in trading stock 10