Page 156 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 156

Chapter 7

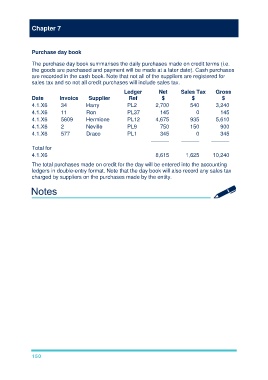

Purchase day book

The purchase day book summarises the daily purchases made on credit terms (i.e.

the goods are purchased and payment will be made at a later date). Cash purchases

are recorded in the cash book. Note that not all of the suppliers are registered for

sales tax and so not all credit purchases will include sales tax.

Ledger Net Sales Tax Gross

Date Invoice Supplier Ref $ $ $

4.1.X6 34 Harry PL2 2,700 540 3,240

4.1.X6 11 Ron PL37 145 0 145

4.1.X6 5609 Hermione PL12 4,675 935 5,610

4.1.X6 2 Neville PL9 750 150 900

4.1.X6 577 Draco PL1 345 0 345

–––––– –––––– ––––––

Total for

4.1.X6 8,615 1,625 10,240

The total purchases made on credit for the day will be entered into the accounting

ledgers in double-entry format. Note that the day book will also record any sales tax

charged by suppliers on the purchases made by the entity.

150