Page 159 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 159

The books of prime entry, discounts and sales tax

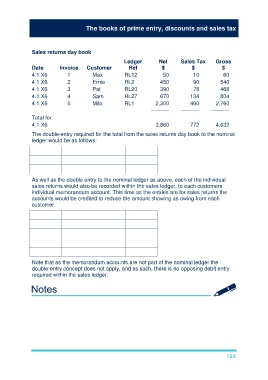

Sales returns day book

Ledger Net Sales Tax Gross

Date Invoice Customer Ref $ $ $

4.1.X6 1 Max RL12 50 10 60

4.1.X6 2 Ernie RL2 450 90 540

4.1.X6 3 Pat RL20 390 78 468

4.1.X6 4 Sam RL27 670 134 804

4.1.X6 5 Milo RL1 2,300 460 2,760

–––––– –––––– ––––––

Total for

4.1.X6 3,860 772 4,632

The double-entry required for the total from the sales returns day book to the nominal

ledger would be as follows:

Debit Sales returns $3,860

Debit Sales Tax $772

Credit Receivables $4,632

As well as the double entry to the nominal ledger as above, each of the individual

sales returns would also be recorded within the sales ledger, to each customers

individual memorandum account. This time as the entries are for sales returns the

accounts would be credited to reduce the amount showing as owing from each

customer.

Credit Max $60

Credit Ernie $540

Credit Pat $468

Credit Sam $804

Credit Milo $2,760

Note that as the memorandum accounts are not part of the nominal ledger the

double-entry concept does not apply, and as such, there is no opposing debit entry

required within the sales ledger.

153