Page 160 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 160

Chapter 7

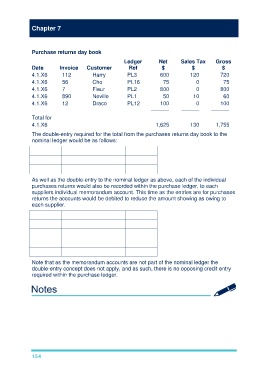

Purchase returns day book

Ledger Net Sales Tax Gross

Date Invoice Customer Ref $ $ $

4.1.X6 112 Harry PL3 600 120 720

4.1.X6 56 Cho PL16 75 0 75

4.1.X6 7 Fleur PL2 800 0 800

4.1.X6 890 Neville PL1 50 10 60

4.1.X6 12 Draco PL12 100 0 100

–––––– –––––– ––––––

Total for

4.1.X6 1,625 130 1,755

The double-entry required for the total from the purchases returns day book to the

nominal ledger would be as follows:

Debit Payables $1,755

Credit Sales Tax $130

Credit Purchases returns $1,625

As well as the double-entry to the nominal ledger as above, each of the individual

purchases returns would also be recorded within the purchase ledger, to each

suppliers individual memorandum account. This time as the entries are for purchases

returns the accounts would be debited to reduce the amount showing as owing to

each supplier.

Debit Harry $720

Debit Cho $75

Debit Fleur $800

Debit Neville $60

Debit Draco $100

Note that as the memorandum accounts are not part of the nominal ledger the

double-entry concept does not apply, and as such, there is no opposing credit entry

required within the purchase ledger.

154