Page 28 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 28

Chapter 1

Example 1

On 31 March, Ahmed’s employment with GSL came to an end and on 1 April,

Ahmed set up in business as a sole trader trading as ‘Ahmed’s Matches’, to

sell boxes of matches from a tray on a street corner.

Ahmed deposited $100 into a bank account opened in the name of Ahmed’s

Matches. He persuaded a supplier of matches to let him have an initial

inventory of 400 boxes, costing 5¢ each, and promised to pay for them one

week later.

During his first day of trading he sold 150 boxes at 12¢ each – generating $18

in cash. Feeling pleased, he took $5 from the cash tin and treated himself to

supper at the local café.

He also wrote a cheque for $5 to his supplier in part payment for the initial

inventory of boxes.

Required:

Illustrate the effect of each of these transactions upon the accounting

equation.

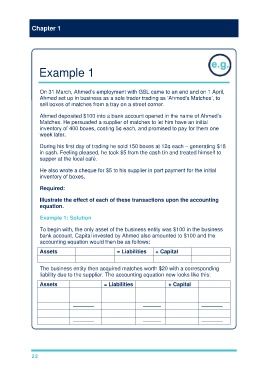

Example 1: Solution

To begin with, the only asset of the business entity was $100 in the business

bank account. Capital invested by Ahmed also amounted to $100 and the

accounting equation would then be as follows:

Assets = Liabilities + Capital

Bank $100.00 = 0 + Capital $100.00

The business entity then acquired matches worth $20 with a corresponding

liability due to the supplier. The accounting equation now looks like this:

Assets = Liabilities + Capital

Bank $100.00 = Payables $20.00 + Capital $100.00

Inventory $20.00

––––––– –––––– –––––––

$120.00 = $20.00 + $100.00

––––––– –––––– –––––––

22