Page 29 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 29

The accounting environment

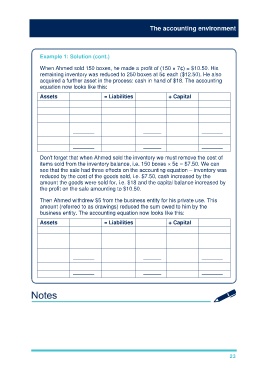

Example 1: Solution (cont.)

When Ahmed sold 150 boxes, he made a profit of (150 × 7¢) = $10.50. His

remaining inventory was reduced to 250 boxes at 5¢ each ($12.50). He also

acquired a further asset in the process: cash in hand of $18. The accounting

equation now looks like this:

Assets = Liabilities + Capital

Bank $100.00 = Payables $20.00 + Capital $100.00

Cash $18.00 + Profit $10.50

Inventory $12.50

––––––– –––––– –––––––

$130.50 = $20.00 + $110.50

––––––– –––––– –––––––

Don't forget that when Ahmed sold the inventory we must remove the cost of

items sold from the inventory balance, i.e. 150 boxes × 5¢ = $7.50. We can

see that the sale had three effects on the accounting equation – inventory was

reduced by the cost of the goods sold, i.e. $7.50, cash increased by the

amount the goods were sold for, i.e. $18 and the capital balance increased by

the profit on the sale amounting to $10.50.

Then Ahmed withdrew $5 from the business entity for his private use. This

amount (referred to as drawings) reduced the sum owed to him by the

business entity. The accounting equation now looks like this:

Assets = Liabilities + Capital

Bank $100.00 = Payables $20.00 + Capital $100.00

Cash $13.00 + Profit $10.50

Inventory $12.50 – Drawings

––––––– –––––– –––––––

$125.50 = $20.00 +

––––––– –––––– –––––––

23