Page 364 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 364

Chapter 20

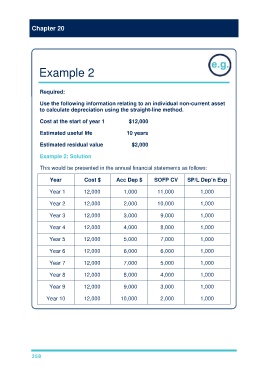

Example 2

Required:

Use the following information relating to an individual non-current asset

to calculate depreciation using the straight-line method.

Cost at the start of year 1 $12,000

Estimated useful life 10 years

Estimated residual value $2,000

Example 2: Solution

This would be presented in the annual financial statements as follows:

Year Cost $ Acc Dep $ SOFP CV SP/L Dep’n Exp

Year 1 12,000 1,000 11,000 1,000

Year 2 12,000 2,000 10,000 1,000

Year 3 12,000 3,000 9,000 1,000

Year 4 12,000 4,000 8,000 1,000

Year 5 12,000 5,000 7,000 1,000

Year 6 12,000 6,000 6,000 1,000

Year 7 12,000 7,000 5,000 1,000

Year 8 12,000 8,000 4,000 1,000

Year 9 12,000 9,000 3,000 1,000

Year 10 12,000 10,000 2,000 1,000

358