Page 366 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 366

Chapter 20

Chapter 6

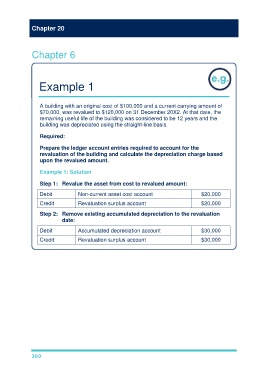

Example 1

A building with an original cost of $100,000 and a current carrying amount of

$70,000, was revalued to $120,000 on 31 December 20X2. At that date, the

remaining useful life of the building was considered to be 12 years and the

building was depreciated using the straight-line basis.

Required:

Prepare the ledger account entries required to account for the

revaluation of the building and calculate the depreciation charge based

upon the revalued amount.

Example 1: Solution

Step 1: Revalue the asset from cost to revalued amount:

Debit Non-current asset cost account $20,000

Credit Revaluation surplus account $20,000

Step 2: Remove existing accumulated depreciation to the revaluation

date:

Debit Accumulated depreciation account $30,000

Credit Revaluation surplus account $30,000

360