Page 369 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 369

Answers to questions

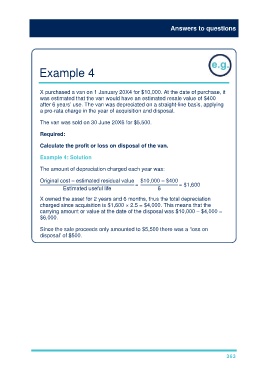

Example 4

X purchased a van on 1 January 20X4 for $10,000. At the date of purchase, it

was estimated that the van would have an estimated resale value of $400

after 6 years’ use. The van was depreciated on a straight-line basis, applying

a pro-rata charge in the year of acquisition and disposal.

The van was sold on 30 June 20X6 for $5,500.

Required:

Calculate the profit or loss on disposal of the van.

Example 4: Solution

The amount of depreciation charged each year was:

Original cost – estimated residual value $10,000 – $400

Estimated useful life = 6 = $1,600

X owned the asset for 2 years and 6 months, thus the total depreciation

charged since acquisition is $1,600 × 2.5 = $4,000. This means that the

carrying amount or value at the date of the disposal was $10,000 – $4,000 =

$6,000.

Since the sale proceeds only amounted to $5,500 there was a ‘loss on

disposal’ of $500.

363