Page 373 - Microsoft Word - 00 BA3 IW Prelims STUDENT.docx

P. 373

Answers to questions

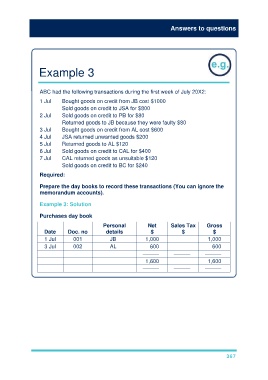

Example 3

ABC had the following transactions during the first week of July 20X2:

1 Jul Bought goods on credit from JB cost $1000

Sold goods on credit to JSA for $800

2 Jul Sold goods on credit to PB for $80

Returned goods to JB because they were faulty $80

3 Jul Bought goods on credit from AL cost $600

4 Jul JSA returned unwanted goods $200

5 Jul Returned goods to AL $120

6 Jul Sold goods on credit to CAL for $400

7 Jul CAL returned goods as unsuitable $120

Sold goods on credit to BC for $240

Required:

Prepare the day books to record these transactions (You can ignore the

memorandum accounts).

Example 3: Solution

Purchases day book

Personal Net Sales Tax Gross

Date Doc. no details $ $ $

1 Jul 001 JB 1,000 1,000

3 Jul 002 AL 600 600

——— ——— ———

1,600 1,600

——— ——— ———

367